A REISSUE (WITHOUT UPDATES) OF THE ORIGINAL POST DATED MAY 1, 2011

* * *

INTRODUCTION

“Three Economic Charts That Will BLOW YOUR MIND,” at RightWing News, offers some tantalizing statistics about the relationship between federal tax receipts and GDP. The bottom line:

The key thing to take away from this is that the amount of revenue the government can bring in via the income tax is, for whatever reason, more inelastic than most people think. That’s yet another reason to put more emphasis on balancing the budget via spending cuts as opposed to trying to fix the problem with tax increases.

Now, if Hauser’s law is as spot-on as it has been in the past … it’s going to be difficult to raise the government’s revenue level much beyond the 20% mark….

I have no quibble with the proposition that the U.S. government has made unaffordable, unilateral “promises” about Social Security, Medicare, and Medicaid benefits. But I must take issue with the focus on the income tax and Hauser’s law, which is

the proposition that, in the United States, federal tax revenues since World War II have always been approximately equal to 19.5% of GDP, regardless of wide fluctuations in the marginal tax rate.

It is necessary to step back from a myopic focus on the federal government and look at all government receipts and expenditures in the United States. The need to do so arises from two facts: (1) State and local spending is substantial, and (2) federal, State, and local finances have become tightly bound together since the advent of revenue sharing and block grants, and with the explosion of federal statutory and regulatory commands to the States.

I begin by looking at the historical record of government income and outgo. That leads me to the future, in which “entitlements” loom unaffordably large . There are three broad paths along which to proceed: cut “entitlements,” borrow considerably more, or tax considerably more. I explain why the second and third options are untenable and economically destructive. The only viable alternative is to cut “entitlements,” and to begin cutting now.

GOVERNMENT SPENDING AND RECEIPTS: THE HISTORICAL RECORD

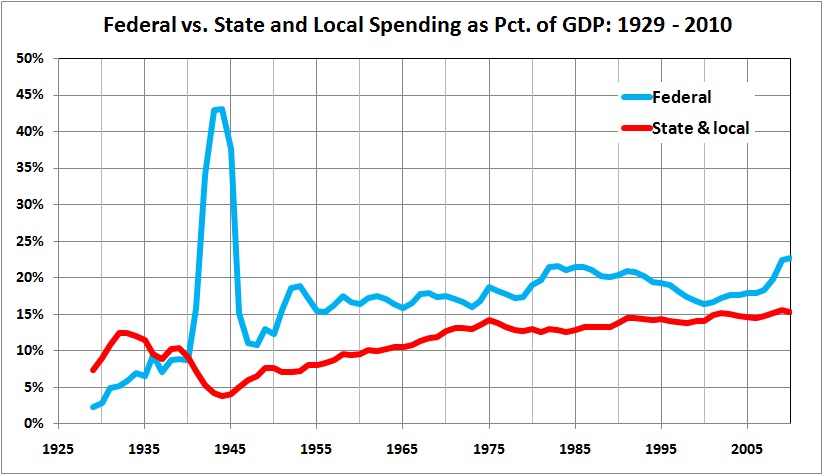

Here is how State and local spending stacks up against federal spending:

Sources: Derived from U.S. Department of Commerce, Bureau of Economic Analysis (BEA), National Income and Product Accounts (NIPA) Tables: Table 3.2 Federal Government Current Receipts and Expenditures (lines 26 and 40-45) and Table 3.3 State and Local Government Current Receipts and Expenditures (line 33).

State and local spending is not insubstantial, and has risen in recent decades, with a lot of help from the federal government. Federal grants to State and local governments have risen steadily from almost zero in 1929 to upwards of 4 percent of GDP in recent years. (I have excluded those grants from federal spending to avoid double-counting.)

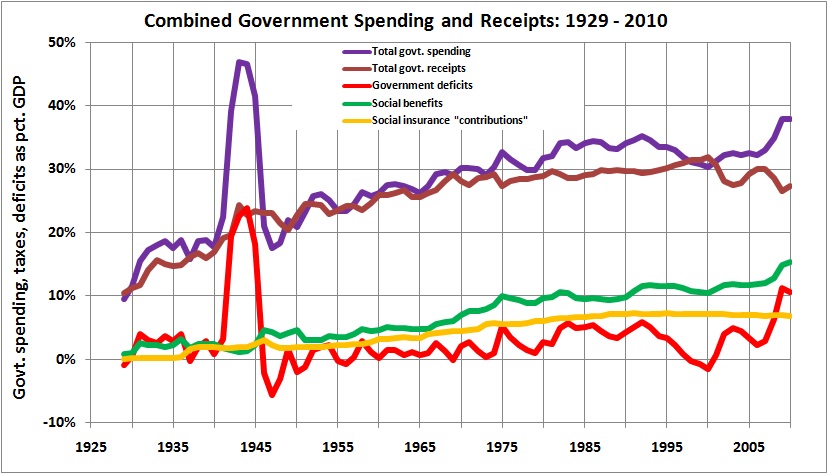

Here is an aggregate picture of federal, State, and local spending and receipts.

Source: Derived from NIPA Table 3.1 Government Current Receipts and Expenditures (lines 7, 19, 30, and 33-39).

Despite Hauser’s “law,” government receipts, as a percentage of GDP, rose steadily from 1929 until 2000, peaking at 32 percent. The post-2000 decline can be attributed to slow economic growth (capped by the recession of 2008-2010) and the so-called Bush tax cuts (which Congress approved initially and again in 2010). I have nothing against the tax cuts, except for the fact that they were not matched by spending cuts. The real burden of government is measured by spending, which diverts resources from productive uses to ones that are less-productive (e.g., public education), counter-productive (e.g., regulation), and downright destructive (i.e., growth-retarding and inflationary). The fact that lenders have increasingly borne the monetary cost of the burden of government has not offset its egregious economic effects. And, as I discuss below, without drastic spending cuts (relative to GDP) there will come a day when lenders will shrug off the burden or demand a much higher price for bearing it.

In any event, regardless of generally diminishing receipts in the first decade of the 21st century, government spending rose as a percentage of GDP, for several reasons. First, there was (and is) slower economic growth, due in no small part to the preceding decades of governmental interference in economic affairs. On top of that, there was Obama’s “stimulus package,” which was meant to end the recession of 2008-2010 but did not (because it could not); the recession ended in the normal way, through the recovery of “animal spirits” and consumer confidence. Then there was (and is) a growing population of persons eligible for Social Security, Medicare (supplemented by “free” or “cheap” prescription drugs), and Medicaid — a population made all the more eager to claim its “entitlements,” given the state of the economy. Finally, and almost incidentally, two foreign wars were fought simultaneously (though with varying degrees of intensity) throughout the decade.

To focus only on federal spending, as I say, is myopic because State and local governments have a habit of raising State and local taxes when so-called federal grants are cut back. (I say “so-called” because the money for those grants is provided largely by taxpayers who are, of course, denizens of the States and their political subdivisions.) In addition to the possibility of higher State and local spending in reaction to cuts in federal largesse, taxpayers — not public-sector unions — should be up in arms about the above-market compensation of government employees. A significant portion of that above-market compensation comes in the form of cushy pension plans, which allow “public servants” to receive high fractions of their salary (sometimes as much as 100 percent) for life, and to begin receiving those payments when they are in their 40s and 50s, after having held a government job for 20 years or so. As a result of these obligations and other undisciplined spending habits, State and local governments have liabilities of more than $7 trillion.

Which brings me to the 500-pound gorilla: the federal government.

“ENTITLEMENTS”: THE SOURCE OF OUR PRESENT AND PROSPECTIVE WOES

Perhaps the most interesting lines in the second graph (above) are the three at the bottom. The gap between the cost of social programs (green line) and “contributions” to those programs (gold line) has risen markedly since the late 1990s. By 2010, the size of that gap — 8.5 percent of GDP — accounted for most deficit spending (red line) — 10.6 percent of GDP. And that is but a hint of things to come. The internet abounds with graphs and tables that depict future federal spending and revenues under various assumptions. They all point to the same conclusion: Spending “commitments” must be cut — and cut drastically — in order to avoid (a) economically disabling tax increases and (b) a day of reckoning in credit markets.

The online offerings include these from the Congressional Budget Office (CBO): “Impact of the President’s Proposals on the Budget Outlook” (blog summary), and “Long Term Analysis of a Budget Proposal by Chairman Ryan” (blog summary). The CBO analyses are somewhat dense and must be read in juxtaposition. They are neatly conjoined by the Committee for a Responsible Federal Budget’s “Analyzing the President’s New Budget Framework.” Here is an informative graphic from that analysis:

Obama’s “framework,” as the report emphasizes, is short on details. It is obviously a slap-dash response to Paul Ryan’s detailed plan (labelled “House Republicans” in the graphic), which is a serious proposal for long-term deficit reduction. To understand the bankruptcy of Obama’s actual budget and current law, which are about the same, one must look beyond 2021.

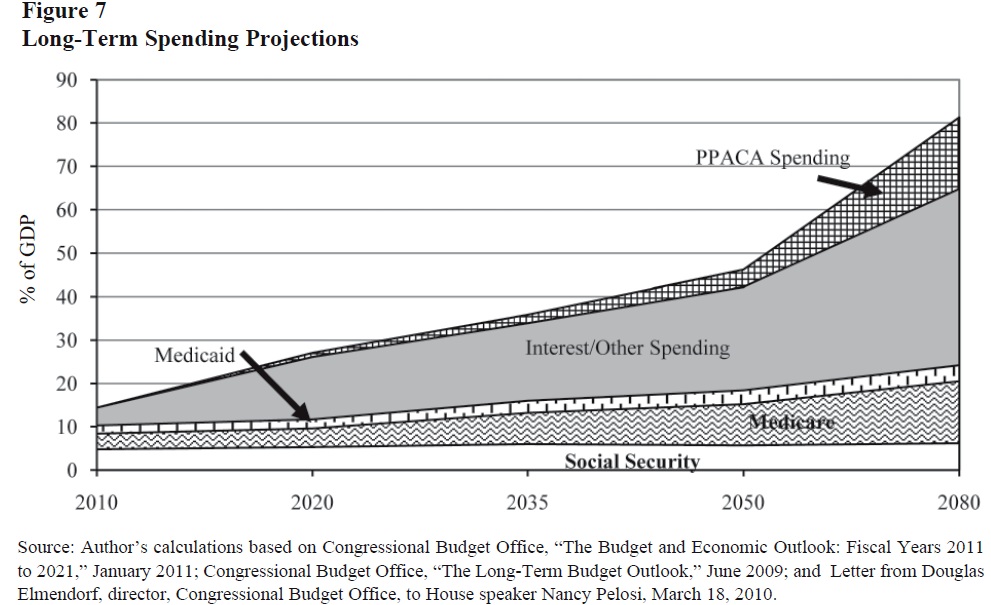

Drawing on CBO’s work, Cato Institute’s Michael Tanner take the long view in “Bankrupt: Entitlements and the Federal Budget.” Tanner leads off with this:

The U.S. government is about to exceed its statutory debt limit of $14.3 trillion. But that actually underestimates the size of the fiscal time bomb that this country is facing. If one considers the unfunded liabilities of programs such as Medicare and Social Security, the true national debt could run as high as $119.5 trillion.

Moreover, to focus solely on debt is to treat a symptom rather than the underlying disease. We face a debt crisis not because taxes are too low but because government is too big. If there is no change to current policies, by 2050 federal government spending will exceed 42 percent of GDP. Adding in state and local spending, government at all levels will consume nearly 60 percent of everything produced in this country. Whether financed through debt or taxes, government that large would be a crushing burden to our economy and our liberties. (p. 1)

Government spending now consumes almost 40 percent of everything produced in this country. Imagine the lives of your children and their children if and when government spending consumes almost 60 percent of everything produced in this country. But wait — it can get worse. Here, Tanner projects federal spending under current law, through 2080:

Add State and local spending and, by 2080, you have an economy whose entire output is claimed by government entities. Some of that output would be directed to individuals for their sustenance, of course. But the form of that sustenance — along with everything else — would be dictated and allocated by politicians and bureaucrats. They — and their favored intellectuals, artists, and athletes — would live reasonably well (though not nearly as well as they could in a free-market system), while the proles would lead lives of hard work, hard drink, and hard deaths. It would be the USSR all over again. And, as with the USSR, the misdirection of economic activity by politicians and bureaucrats would ensure economic stagnation.

It may not come to that, if there are enough voters who understand the consequences of unbridled government spending, and who put liberty and true prosperity above the illusory promises of security offered by the big-government crowd. But as time goes by and more voters become accustomed to handouts, they will become “European” in their embrace of the welfare state. Slippery slopes and death-spirals lead to the same slough of despond (second definition).

That said, is there a way to have “our” cake and eat it, too? Can the U.S. government raise enough money through borrowing or taxation to fend off the day of reckoning and attain the left’s dream of attaining “Europeanism”?

BORROWING A SEA OF TROUBLES

In fact, financial markets may help to reign in government spending by sending signals that cannot be ignored — if the U.S. government borrows money from willing lenders instead of just printing it. (Economist Karl Smith explains why printing money — deliberate inflation — is an unlikely course of action. He refers to “structured default,” which is explained here.) As government spending rises, and as voters and politicians (in the main) reject significant tax increases, government debt will rise to unprecedented heights. Here, from The Heritage Foundation’s 2011 Budget Chart Book, is a retrospective and prospective look at the size of the federal government’s debt in relation to GDP:

Financial markets will reject U.S. government debt — or charge a lot for carrying it — long before it reaches the levels shown above. The events of year ago, when Greece’s financial bind came to a head, gave a hint of the likely reaction of markets to continued fiscal profligacy. Then, earlier this month, there was a sharp, brief stock-market sell off in response to an announcement by Standard & Poor’s about U.S. government debt (“‘AAA/A-1+’ Rating On United States of America Affirmed; Outlook Revised To Negative“):

- We have affirmed our ‘AAA/A-1+’ sovereign credit ratings on the United States of America.

- The economy of the U.S. is flexible and highly diversified, the country’s effective monetary policies have supported output growth while containing inflationary pressures, and a consistent global preference for the U.S. dollar over all other currencies gives the country unique external liquidity.

- Because the U.S. has, relative to its ‘AAA’ peers, what we consider to be very large budget deficits and rising government indebtedness and the path to addressing these is not clear to us, we have revised our outlook on the long-term rating to negative from stable.

- We believe there is a material risk that U.S. policymakers might not reach an agreement on how to address medium- and long-term budgetary challenges by 2013; if an agreement is not reached and meaningful implementation is not begun by then, this would in our view render the U.S. fiscal profile meaningfully weaker than that of peer ‘AAA’ sovereigns.

If there is no serious effort to control the growth of the U.S. government’s debt by scaling back “entitlements,” two things will happen: Interest rates will rise, thus compounding the problem, and lenders will back away. Megan McArdle outlines a plausible scenario:

Right now, when Treasury goes to sell new bonds, it enters a fairly robust market, with not just the Fed but a bunch of fairly price-inelastic Asian central banks who are willing to take on our bonds at whatever the market offers. If China exits the market, we will either need to borrow less, or attract new lenders by offering higher interest rates. Even a noticeable decrease in volume would force us to pay more for our deficits….

… A lot of people tend to assume that there will be warning signs telling us that we need to get our fiscal house in order: China will slow down its bond purchases, interest rates will gradually rise. But in fact, the lesson of fiscal crises is that the “warning signs” we’re watching for often are the crisis. Unless interest rates increase (or debt buying decrease–which is really the same thing) in a very gradual, orderly fashion, then by the time your interest rates rise, it is already too late to do anything easy; your debt service burden forces you into dramatic fiscal measures, or default.

According to economist Carmen Reinhart, who has made an intensive study of crises, there’s no reason to expect the change to be orderly and gradual. She says the lesson of history is pretty unequivocal: interest rates are not a good predictor of who is about to tip into a crisis. People are willing to lend at decent rates, until suddenly they’re barely willing to lend at all.

When you look at how much of our debt comes due by the end of 2012, it’s easy to see how fast higher interest rates could turn into a real problem for us. To be sure, we’re no Japan–but that’s not necessarily a happy thought, because Japan finances something like 95% of its debt from its pool of thrifty (and nationalistic) savers. Their stock of lenders probably isn’t going anywhere. Ours might.

Lawrence Kotlikoff agrees:

…CBO’s baseline budget updates suggest the date for reaching what Carmen Reinhart, Kenneth Rogoff and other prominent economists believe is a critical insolvency threshold — a 90 percent ratio of federal debt held by the public to gross domestic product — has moved four years closer, in just nine months!…

And if foreigners balk at buying U.S. debt, why would Americans fill the breach? Is there a patriotic duty to finance socialism?

In summary, it seems unlikely that the U.S. can erect a full-blown welfare state on the backs of lenders. Can it be done on backs of taxpayers?

TAXING “THE RICH” — AND A LOT OF OTHERS, TOO?

The short answer to the preceding question is “no.” In evidence, I return to Michael Tanner’s “Bankrupt: Entitlements and the Federal Budget“:

Many observers suggest that we can simply tax the rich. For example, the Center for American Progress has recommended, among other things, imposing a 5–7 percent surtax on households with incomes above $500,000 per year, eliminating the cap on Social Security payroll taxes, increasing the estate tax, and raising the top marginal tax rate on capital gains and dividends.60 That would potentially raise the total marginal tax burden on some people to well above 50 percent.

Setting aside the simple immorality of government taking such an enormous portion of anyone’s income, there are many reasons to be skeptical of such an approach, starting with the fact that it may not actually generate any additional revenue….

…[I]ncentives matter. At some point taxes become high enough to discourage economic activity and therefore produce less revenue than would be predicted under a more static analysis….

But even if one assumes that taxes can be raised without having any impact on economic growth, taxing the rich still wouldn’t get us out of our budget hole—because the hole is quite simply bigger than the amount of revenue we could raise from taxing the rich even if there were no disincentives. To put it in admittedly oversimplified perspective: our current obligations, including both implicit and explicit debt, total more than 900 percent of GDP. The combined wealth of everyone in the United States who earns at least $1 million per year equals roughly 100 percent of GDP…. Therefore, you could confiscate the entire wealth of every millionaire in the United States and still barely make a dent in the amount we will owe.

Clearly, therefore, any tax increases would have to extend well beyond “the rich.” In fact, the Congressional Budget Office said in 2008 that in order to pay for all currently scheduled federal spending both the corporate tax rate and top income tax rate would have to be raised from their current 35 percent to 88 percent, the current 25 percent tax rate for middle-income workers to 63 percent, and the 10 percent tax bracket for low-income workers to 25 percent. It is likely, given increased spending since then, that the required tax levels would be even higher today.

Regardless of how one feels about taxing the rich, taxes at those levels would be devastating to future economic growth.

Harvard economist Martin Feldstein points out that the actual loss from tax increases to the private sector is a combination of the confiscated revenue as well as a hidden cost of the actual increase, known as deadweight loss. This hidden cost can be very expensive. Feldstein calculates that “the total cost per incremental dollar of government spending, including the revenue and the deadweight loss, is . . . a very high $2.65. Equivalently, it implies that the marginal excess burden per dollar of revenue is $1.65.” This means that for every 1 percent of GDP needed to be raised in revenue, the equivalent of 2.65 percent of GDP needs to be extracted from the private sector first.

Clearly, tax increases required to finance an increase in spending of more than 40 percent of GDP would place an impossible burden on the private economy. (pp. 13-4, source notation omitted)

One more thing (from Table 1 of the Tax Foundation’s “Fiscal Facts“): For 2008, federal income tax returns with adjusted gross incomes in the top 1 percent accounted for 38 percent of income taxes; the top 5 percent, 59 percent; the top 10 percent, 70 percent; the top 25 percent, 86 percent; and the top 50 percent, 97 percent. Not only that, but the top 10 percent of American taxpayers is taxed more heavily than the top 10 percent in other developed countries, including those “advanced” European countries that American leftists would like to emulate. (See “No Country Leans on Upper-Income Households as Much as U.S.” at the Tax Foundation’s Tax Policy Blog.) And the left has the gall to claim that America’s “rich” aren’t paying enough taxes!

VIVE LA RÉSISTANCE

It will not do simply to put an end to the U.S. government’s spending spree; too many State and local governments stand ready to fill the void, and they will do so by raising taxes where they can. As a result, some jurisdictions will fall into California- and Michigan-like death-spirals while jobs and growth migrate to other jurisdictions. Contemporary mercantilists to the contrary, the “winners” are “losers,” too. Even if Congress resists the urge to give aid and comfort to profligate States and municipalities at the expense of the taxpayers of fiscally prudent jurisdictions, the high taxes and anti-business regimes of California- and Michigan-like jurisdictions impose deadweight losses on the whole economy. If you believe otherwise, you believe in the broken-window fallacy, wherein an economically destructive force (natural or governmental) is credited with creating jobs and wealth because it leads to the visible expenditure of effort and resources.

So, the resistance to economically destructive policies cannot end with efforts to reverse the policies of the federal government. But given the vast destructiveness of those policies — “entitlements” in particular — the resistance must begin there. Every conservative and libertarian voice in the land must be raised in reasoned opposition to the perpetuation of the unsustainable “promises” currently embedded in Social Security, Medicare, and Medicaid — and their expansion through Obamacare. To those voices must be added the voices of “moderates” and “liberals” who see through the proclaimed good intentions of “entitlements” to the economic and libertarian disaster that looms if those “entitlements” are not pared down to their original purpose: providing a safety net for the truly needy.

The alternative to successful resistance is stark: more borrowing, higher interest payments, unsustainable debt, higher taxes, and economic stagnation (at best).

Price-Earnings ratios as a predictor of twenty-year returns based upon the plot by

Price-Earnings ratios as a predictor of twenty-year returns based upon the plot by