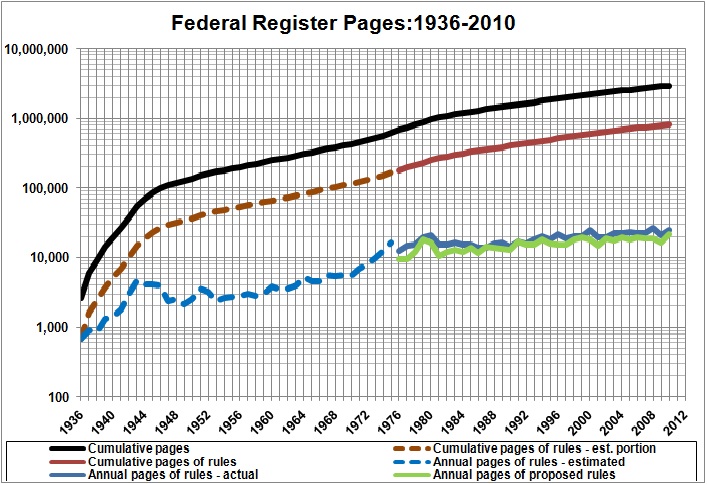

UPDATE 02/05/17: The website of the Office of the Federal Register has eliminate or very cleverly hidden the source of statistics summarized in the graph below. Alternative sources, as of this date, are here and here.

The Office of the Federal Register, undoubtedly proud of its role in the imposition of rules on Americans, publishes a statistical summary of its handiwork, from which I derived the following graph:

Source: Go to OFR page headed Tutorials, History, and Statistics and under Statistics click on XLS. Number of pages of rules for 1936-1975 estimated from the relationship between the number of pages of rules and the total number of pages in the Federal Register for 1976-2010.

Not all of the rules adopted since 1936 are still in effect, of course, but the graph gives a good indication of the growth and weight of the regulatory burden that hampers Americans and their enterprises. Do not take solace in the slower growth of rule-making pages since 1976; the page count continues to rise. Any number greater than zero represents the foreclosure of consumers’ and producers’ options — the further diminution of liberty, in other words.

How bad is it, economically? A report issued under the aegis of the U.S. Small Business Administration (yes, an arm of the central government) concludes that

the annual total cost of all federal regulations in 2008 was $1.752 trillion. Of this amount, the annual direct burden on business is $970 billion. Economic regulations represent the most costly category, with a total cost of $1.236 trillion, and with $618 billion falling initially on business. Environmental regulations represent the second most costly category in terms of total cost ($281 billion), and the cost apportioned to business is $183 billion. Compliance with the federal tax code is the third most costly category ($160 billion), and the cost of occupational safety and health, and homeland security regulations ranks last ($75 billion). (Nicole V. Crain and W. Mark Crain, Lafayette College, “The Impact of Regulatory Costs on Small Firms,” for SBA Office of Advocacy, September 2010, p. 48; cited and summarized on SBA’s website, here)

In other words governmental impositions in 2008 — a regulatory burden of $1.75 trillion and spending of $5.02 trillion — accounted for 47 percent of that year’s GDP ($14.29 trillion, in current dollars). As I have shown in other posts (e.g., here and here) the cumulative effect of governmental impositions is far greater than that.

Related reading: Henry I. Miller, “Red Tape and Pink Slips: Obama’s Imaginary Regulatory Reform,” The American, February 2, 2012

Related posts:

The Price of Government

The Price of Government Redux

The Mega-Depression

Ricardian Equivalence Reconsidered

The Real Burden of Government

Toward a Risk-Free Economy

The Rahn Curve at Work

The Illusion of Prosperity and Stability

The “Forthcoming Financial Collapse”

Estimating the Rahn Curve: Or, How Government Inhibits Economic Growth

The Deficit Commission’s Deficit of Understanding

Undermining the Free Society

The Bowles-Simpson Report

The Bowles-Simpson Band-Aid

Build It and They Will Pay

Government vs. Community

The Stagnation Thesis

America’s Financial Crisis Is Now

Money, Credit, and Economic Fluctuations

A Keynesian Fantasy Land

“Tax Expenditures” Are Not Expenditures

The Keynesian Fallacy and Regime Uncertainty

The Great Recession Is Not Over

Why the “Stimulus” Failed to Stimulate

Regime Uncertainty and the Great Recession

The Real Multiplier

Vulgar Keynesianism and Capitalism

Why Are Interest Rates So Low?

Economic Growth Since World War II

The Commandeered Economy

Estimating the Rahn Curve: A Sequel

The Real Multiplier (II)