I have written several posts about political and economic paradoxes in the past 18 years. Here are the highlights (with some commentary).

The paradox of libertarianism:

Liberty rests on an agreed definition of harm, and on an accompanying agreement to act with mutual restraint and in mutual defense. Given the variety of human wants and preferences, the price of mutual restraint and mutual defense is necessarily some loss of liberty. That is, each person must accept, and abide by, a definition of harm that is not the definition by which he would abide were he able to do so. But, in return for mutual restraint and mutual defense, he must abide by that compromise definition.

That insight carries important implications for the “anything goes” or “do your own thing” school of pseudo-libertarianism. That school consists of those libertarians who believe that harm is in the mind of the doer, or who believe that they can define harm while standing on the outside of society looking in. Thus they proclaim abortion and same-sex “marriage” (among other things) to be harmless — just because they favor abortion and same-sex “marriage” or cannot see the harm in them.

I am therefore a conservative libertarian.

- Conservative because voluntarily evolved social norms are binding and civilizing, and therefore should not be dismissed out of hand or altered peremptorily.

- Libertarian in a minarchistic way. The urge to power makes a state inevitable; the best state is therefore the one that only defends its citizens from predators, domestic and foreign.

A non-paradox for libertarians:

What if a society’s transition from a regulatory-welfare regime to a regime of liberty were to result in losers as well as winners? How could one then justify such a transition? Must the justification rest on an intuitive judgment about the superiority of liberty? Might the prospect of creating losers somehow nullify the promise of creating winners?

I argue … that my justification for libertarianism — although it is of the consequentialist-utilitarian variety — rests on a stronger foundation than an intuitive judgment about the superiority of liberty…. The virtue of libertarianism … is not that it must be taken on faith but that, in practice, it yields superior consequences. Superior consequences for whom, you may ask. And I will answer: for all but those who don’t wish to play by the rules of libertarianism; that is, for all but predators and parasites.

By predators, I mean those who would take liberty from others, either directly (e.g., through murder and theft) or through the coercive power of the state (e.g., through smoking bans and licensing laws). By parasites, I mean those who seek to advance their self-interest through the coercive power of the state rather than through their own efforts (e.g., through corporate welfare and regulatory protection)….

[A] transition to liberty might not instantly make everyone better off … but everyone could be better off. That’s simply not the case with the regulatory-welfare state, which robs some for the benefit of others, and ends up making almost everyone poorer than they would be in a state of liberty.

Liberty is a win-win proposition for everyone except those who deserve to lose.

The interest-group paradox:

Pork-barrel legislation exemplifies the interest-group paradox in action, though the paradox encompasses much more than pork-barrel legislation. There are myriad government programs that — like pork-barrel projects — are intended to favor particular classes of individuals. Here is a minute sample:

-

- Social Security, Medicare, and Medicaid, for the benefit of the elderly (including the indigent elderly)

-

- Tax credits and deductions, for the benefit of low-income families, charitable and other non-profit institutions, and home buyers (with mortgages)

-

- Progressive income-tax rates, for the benefit of persons in the mid-to-low income brackets

-

- Subsidies for various kinds of “essential” or “distressed” industries, such as agriculture and automobile manufacturing

-

- Import quotas, tariffs, and other restrictions on trade, for the benefit of particular industries and/or labor unions

-

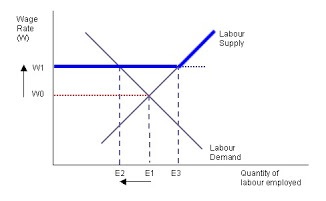

- Pro-union laws (in many States), for the benefit of unions and unionized workers

-

- Non-smoking ordinances, for the benefit of bar and restaurant employees and non-smoking patrons.

What do each of these examples have in common? Answer: Each comes with costs. There are direct costs (e.g., higher taxes for some persons, higher prices for imported goods), which the intended beneficiaries and their proponents hope to impose on non-beneficiaries. Just as importantly, there are indirect costs of various kinds (e.g., disincentives to work and save, disincentives to make investments that spur economic growth). (Exercise for the reader: Describe the indirect costs of each of the examples listed above.)

You may believe that a particular program is worth what it costs… The problem is millions of your fellow Americans believe the same thing about each of their favorite programs. Because there are thousands of government programs (federal, State, and local), each intended to help a particular class of citizens at the expense of others, the net result is that almost no one in this fair land enjoys a “free lunch.” Even the relatively few persons who might seem to have obtained a “free lunch” — homeless persons taking advantage of a government-provided shelter — often are victims of the “free lunch” syndrome….

The paradox that arises from the “free lunch” syndrome is much … like the paradox of panic, in that there is a crowd of interest groups rushing toward a goal — a “pot of gold” — and (figuratively) crushing each other in the attempt to snatch the pot of gold before another group is able to grasp it. The gold that any group happens to snatch is a kind of fool’s gold: It passes from one fool to another in a game of beggar-thy-neighbor, and as it passes much of it falls into the maw of bureaucracy.

The interest-group paradox has dominated American politics since the advent of “Progressivism” in the late 1800s. Today, most Americans are either “progressives” or victims of “progressivism”. All too often they are both.

The capitalist paradox meets the interest-group paradox:

An insightful post at Imlac’s Journal includes this quotation:

Schumpeter argued the economic systems that encourage entrepreneurship and development will eventually produce enough wealth to support large classes of individuals who have no involvement in the wealth-creation process. This generates apathy or even disgust for market institutions, which leads to the gradual takeover of business by bureaucracy, and eventually to full-blown socialism. [Matt McCaffrey, “Entrepreneurs and Investment: Past, Present, … Future?,” International Business Times, December 9, 2011]

This, of course, is the capitalist paradox, of which the author of Imlac’s Journal writes. He concludes with these observations:

[U]nder statist regimes, people’s choices are limited or predetermined. This may, in theory, obviate certain evils. But as McCaffrey points out, “the regime uncertainty” of onerous and ever changing regulations imposed on entrepreneurs is, ironically, much worse than the uncertainties of the normal market, to which individuals can respond more rapidly and flexibly when unhampered by unnecessary governmental intervention.

The capitalist paradox is made possible by the “comfort factor” invoked by Schumpeter. (See this, for example.) It is of a kind with the foolishness of extreme libertarians who decry defense spending and America’s “too high” rate of incarceration, when it is such things that keep them free to utter their foolishness.

The capitalist paradox also arises from the inability and unwillingness of politicians and voters to see beyond the superficial aspects of legislation and regulation. In Bastiat‘s words,

a law produces not only one effect, but a series of effects. Of these effects, the first alone is immediate; it appears simultaneously with its cause; it is seen. The other effects emerge only subsequently; they are not seen; we are fortunate if we foresee them.

The unseen effects — the theft of Americans’ liberty and prosperity — had been foreseen by some (e.g., Tocqueville and Hayek). But their wise words have been overwhelmed by ignorance and power-lust. The masses and their masters are willfully blind and deaf to the dire consequences of the capitalist paradox because of what I have called the interest-group paradox [see above].

The paradox that is Western civilization:

The main weakness of Western civilization is a propensity to tolerate ideas and actions that would undermine it. The paradox is that the main strength of Western civilization is a propensity to tolerate ideas and actions that would strengthen it. The survival and improvement of Western civilization requires carefully balancing the two propensities. It has long been evident in continental Europe and the British Isles that the balance has swung toward destructive toleration. The United States is rapidly catching up to Europe. At the present rate the intricate network of social relationships and norms that has made America great will be destroyed within a decade. Israel, if it remains staunchly defensive of its heritage, will be the only Western nation still worthy of the name.

I wrote that almost five years ago. America network of social relationships and norms is (sadly) on schedule for destruction — unless there is a sharp and lasting turnaround in the governance of the country.

A paradox for (old-fashioned) liberals:

[A definition of old-fashioned liberalism is] given here by one Zack Beauchamp:

[L]iberalism refers to a school of thought that takes freedom, consent, and autonomy as foundational moral values. Liberals agree that it is generally wrong to coerce people, to seize control of their bodies or force them to act against their will….

Beauchamp, in the next paragraph, highlights the paradox inherent in liberalism:

Given that people will always disagree about politics, liberalism’s core aim is to create a generally acceptable mechanism for settling political disputes without undue coercion — to give everyone a say in government through fair procedures, so that citizens consent to the state’s authority even when they disagree with its decisions.

Which is to say that liberalism does entail coercion [how much is “undue” depends on whose ox is being gored]. Thus the paradox. (What is now called “liberalism” in America is so rife with coercion [link added] that only a person who is ignorant of the meaning of liberalism can call it that with a straight face.)

Socialism, communism, and three paradoxes:

The only substantive difference between socialism and communism, in theory, is that communism somehow manages to do away with the state. This, of course, never happens, except in real communes, most of which were and are tiny, short-lived arrangements. (In what follows, I therefore put communism in “sneer quotes”.)

The common thread of socialism and “communism” is collective ownership of “equity”, that is, assets (including the means of production). But that kind of ownership eliminates an important incentive to invest in the development and acquisition of capital improvements that yield more and better output and therefore raise the general standard of living. The incentive, of course, is the opportunity to reap a substantial reward for taking a substantial risk. Absent that incentive, as has been amply demonstrated by the tragic history of socialist and “communist” regimes, the general standard of living is low and economic growth is practically (if not actually) stagnant.

So here’s the first paradox: Systems that, by magical thinking, are supposed to make people better off do just the opposite: They make people worse off than they would otherwise be.

All of this because of class envy. Misplaced class envy, at that. “Capitalism” (a smear word) is really the voluntary and relatively unfettered exchange of products and services, including labor. Its ascendancy in the West is just a happy accident of the movement toward the kind of liberalism exemplified in the Declaration of Independence and Constitution. People were liberated from traditional economic roles and allowed to put their talents to more productive uses, which included investing their time and money in capital that yielded more and better products and services.

Most “capitalists” in America were and still are workers who make risky investments to start and build businesses. Those businesses employ other workers and offer things of value that consumers can take or leave, as they wish (unlike the typical socialist or “communist” system).

So here’s the second paradox: Socialism and “communism” actually suppress the very workers whom they are meant to benefit, in theory and rhetoric.

The third paradox is that socialist and “communist” regimes like to portray themselves as “democratic”, even though they are quite the opposite: ruled by party bosses who bestow favors on their protegees. Free markets are in fact truly democratic, in that their outcomes are determined directly by the participants in those markets.

The paradoxes and consequences of liberty and prosperity:

The soil in which the seeds of [America’s] decline were to be planted was broken in the Progressive Era of the late 19th and early 20th centuries. The seeds were planted and nourished by “leaders”, “intellectuals”, and “activists” from TR’s time to the present. The poisonous crop burst blossomed brightly in the 1930s and again in the 1960s, but it had not yet engulfed the land. It continued to spread slowly (and often unheeded) for several decades before racing across the land in recent years. Its poisonous vines are now strangling liberty and prosperity.

These are the paradoxes of liberty and prosperity: Without a moral foundation they lead to their own destruction.

If you value liberty, you do not countenance speech and actions that subvert it. If you value prosperity, you must be careful not to let it breed the kind of idleness (of mind and body) that gives rise to speech and actions that subvert liberty — and thus prosperity.

The Founders understood those things. They believed that the Constitution would preserve liberty and foster prosperity because they believed that Americans would remain religious and moral. They did not believe that Americans would undermine liberty by being soft on crime, by feeding masses (and elites) at the public trough (and at the expense of taxpayers), or by accommodating foreign aggression. They did not believe that Americans would countenance such things, nor that political leaders would suborn and join efforts to ostracize, suppress, and oppress those Americans who oppose such things.

The Founders, sadly, were wrong. The did not and could not foresee these events (and many more not mentioned):

-

- A goodly fraction of Americans would spurn religion and become morally slack and complacent about the preservation of liberty.

- Freedom of speech and assembly would be turned against liberty, to foster crime, lack of personal responsibility, and the accommodation of deadly enemies, within and without.

- Firearms, always omnipresent in America for useful purposes, would become violent, murderous extensions of a growing tendency to toward psychological instability in a morally rootless populace.

- Governments, political “elites”, and corporations would celebrate and reward (or fail to punish) persons based on the color of their skin (as long as it isn’t white or “yellow”)*, their pro-constitutional political views (which “exonerate” many whites), and their sex (preferably female or confused).

- Abortion would become legal and support for abortion would be openly and boastfully proclaimed by political leaders and “elites”. Unborn human beings would be disposed of as inconveniences and treated like garbage.

- Parents would lose control of the upbringing of their children, who might be cajoled into psychologically devastating treatments and surgeries by teachers and others under the rubric of “gender-affirming care”.

- Women and girls would be forced to room with, shower with, and compete against males who “identify” as females (or “other”).

- Intelligence and superior (non-athletic) skills would be denounced as unfair and “white supremacist” (with Asians counting as white).

- Lawlessness and pathological deviancy would be rewarded (or not punished).

- Leading politicians and “activists” would bay and howl for the confiscation of arms, under the rubric of “gun control”, when the underlying problem isn’t gun ownership by moral and mental depravity.

- Political “leaders” would enable and allow a virtual invasion of the country, despite its negative consequences for the “little people” whom those “leaders” and other “elites” claim to champion.

- The national government (and many others) would ignore science and invoke pseudo-science to force Americans into isolation, disrupt the economy, and burden the poorest Americans because of a virus that would have run its course naturally and less destructively than had it been combated scientifically.

- The national government (and many others) would ignore science and invoke pseudo science to make Americans (especially poor Americans) poorer in an unnecessary and futile quest to “save the planet” from the use of fossil fuels, fertilizers, and other productive substances that the majority of the world’s populace will not refrain from using. (Regarding the state of science, see Maggie Kelly’s, “Professors Publish ‘Controversial’ Paper Defending Merit in Science”, The College Fix, May 2, 2023.)

- Prosperity — a fruit of liberty — would foster the moral softness and the mental laxity that gives rise to addle-pated schemes such as those outlined above.

- Vast numbers of Americans — having been indoctrinated in public schools, in left-dominated universities, and by the Democrat-allied media — would believe and subscribe to such schemes, which are made palatable by the application of double-speak labels to them (e.g., “defense of the homeland”, “combating misinformation”, “following the science”).

- Government officials, including law-enforcement officers, would collude with and encourage the press and other purveyors of “information” to distort and suppress facts about much that is alluded to above, to discredit and hound a president (Trump) who opposed them, and to help elect and protect possibly the most corrupt president in America’s history (Biden) because it is through him that the left’s agenda is being implemented.

- All of this (and more) would occur because almost-absolute power would accrue to the morally (and sometimes venally) corrupt politicians and their powerful enablers who advance and enforce such schemes.

….

In the best of possible worlds, there would be a voluntary return to something much closer to the America that the Founders envisioned. (Even a return to the post-New Deal 1940s and 1950s would do.) …

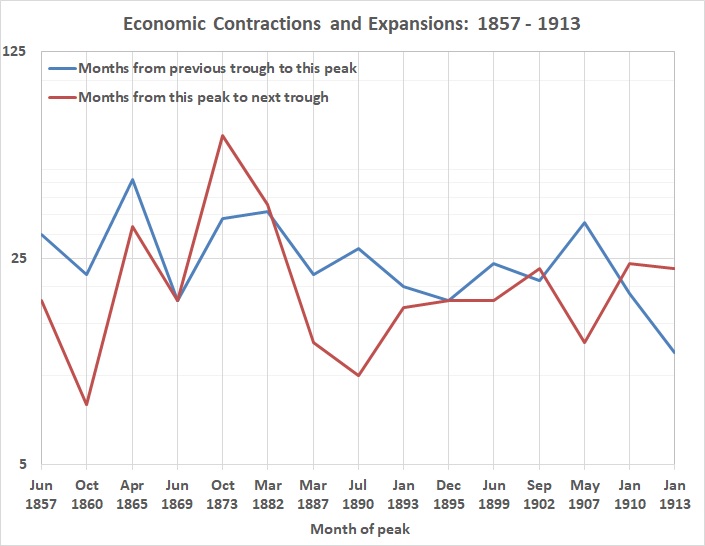

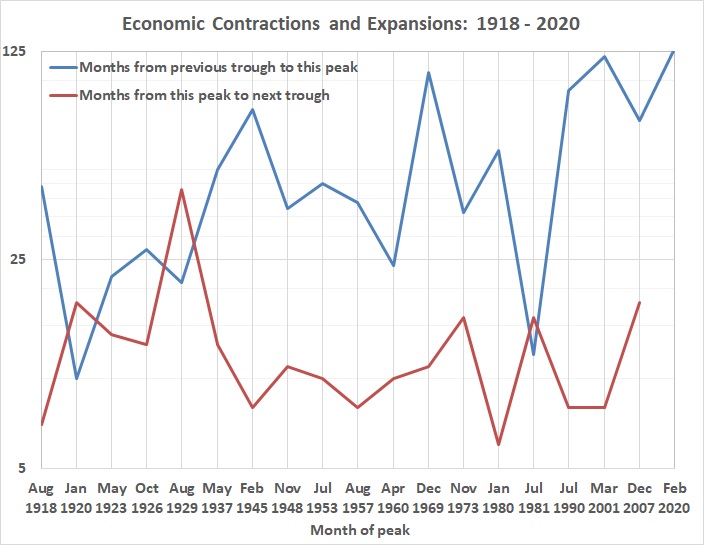

I don’t mean something like the turnaround in the House of Representatives following the elections of 1994 and 2010 (GOP gains of 12 and 15 percent). I mean something like the turnaround of 1930-1932 (total Democrat gains of 91 percent). In the wake of that turnaround, Democrats went on to control the House for the next 60 years (except for a post-World War II reaction of two years).

But the mass rejection of the GOP in 1930 and 1932 was a consequence of an economic upheaval, the Great Depression, that hit vast numbers of Americans and hit them suddenly and hard where it hurts: in the pocketbook. The policies that are now engulfing the land, onerous as they may be, are insidious by comparison — and are practically ignored or touted as “good things” by most media (including “entertainment” media).

Moreover, “woke” America is the laughing-stock of its enemies. And too weak [under the present regime] to stare them down. The growing unwillingness and inability of America’s “leaders” to deter and fight enemies really doesn’t matter to those enemies. In the end, the will to resist aggression and to accede to the wishes of aggressors depends on the will of the populace to stand together against aggression. That will, in turn, depends on broad (if not unanimous) allegiance to the survival and success of the nation.

There is no longer such an allegiance. The left hates what America long was and will not relent until that America is destroyed. The right hates what America is rapidly becoming at the hands of the left. A house divided against itself cannot stand.

I used to believe that an event that threatened the lives and livelihoods of all Americans would re-unite them. I no longer believe that.

I now believe that a national divorce — a negotiated partition of the nation — is a dire necessity. (Its precursor, a concerted secession, is legal under the Constitution.) It would allow a large fraction of Americans, perhaps half of them, to break free of the economic and social oppressions that emanate from Washington. It would also allow those same Americans to defend themselves against invaders from the south and overseas enemies instead of wasting their treasure on the left’s destructive agenda.

Absent a national divorce, everyone will go down with a sinking ship. Across the land there will be declining material comfort, rising criminality, rampant social acrimony, the suppression of views that threaten the grip of the ruling class, the oppression of persons who express those views, and a fascistic arrangement between politicians and favored corporations — those that subscribe to the quasi-religion of “climate change” and the “wokeness” that propels schemes that put skin color, sex (or lack of it), and other personal characteristics above truth, above merit, and above the rule of law.

Which leads me to promote “Can America Be Saved?“, if you haven’t yet read it.