This is the second entry in what I hope will become a book-length series of posts. That result, if it comes to pass, will amount to an unorthodox economics textbook. Here are the chapters that have been posted to date:

1. What Is Economics?

2. Pitfalls

3. What Is Scientific about Economics?

4. A Parable of Political Economy

5. Economic Progress, Microeconomics, and Macroeconomics

A person who wants to learn about economics should be forewarned about pernicious tendencies and beliefs — often used unthinkingly and expressed subtly — that lurk in writings and speeches about economics and economic issues. This chapter treats seven such tendencies and beliefs:

- misuse of probability

- reductionism

- nirvana fallacy

- social welfare

- romanticizing the state

- paternalism

- judging motives instead of results

MISUSE OF PROBABILITY

Probability is seldom invoked in non-technical economics. But when it is, beware of it. A statement about the probability of an event is either (a) a subjective evaluation (“educated” guess) about what is likely to happen or (b) a strict, mathematical statement about the observed frequency of the occurrence of a well-defined random event. I will bet you even money that the first meaning applies in at least six of the next ten times that you read or hear a statement about probability or its cognate “chance,” as in 50-percent chance of rain. And my subjective evaluation is that I have a 90-percent probability of winning the bet.

Let’s take the chance of rain (or snow or sleet, etc.). You may rely heavily on a weather forecaster’s statement about the probability that it will rain today. If the stated probability is high, you may postpone an outing of some kind, or take an umbrella when you leave the house, or wear a water-repellent coat instead of a cloth one, and so on. That’s prudent behavior on your part, even though the weather forecaster’s statement isn’t really probabilistic.

What the weather forecaster is telling you (or relaying to you from the National Weather Service) is a subjective evaluation of the “chance” that it will rain in a given geographic area, based on known conditions (e.g., wind direction, presence of a nearby front, water-vapor imagery). The “chance” may be computed mathematically, but its computation rests on judgments about the occurrence of rain-producing events, such as the speed of a front’s movement and the direction of water-vapor flow. In the end, however, you’re left with only a weather forecaster’s judgment, and it’s up to you to evaluate it and act accordingly.

What about something that involves “harder” numbers, such as the likelihood of winning a lottery (where there’s good information about the number of tickets sold) or casting the deciding vote in an election (where there’s good information about the number of votes that will be cast)? I will continue with the case of voting, which is discussed in chapter 1 as an example of the extent to which economics has spread beyond its former preoccupations with buyers, sellers, and the aggregation of their activities.

An economist named Bryan Caplan has written a lot about voting. For example, he says the following in “Why I Don’t Vote: The Honest Truth” (EconLog, September 13, 2016):

Aren’t we [economists] always advising people to choose their best option, even when their best option is bleak? Sure, but abstention [from voting] is totally an option. And while politicians have a clear incentive to ignore we abstainers, only remaining aloof from our polity gives me inner peace.

You could respond, “Inner peace at what price?” It is only at this point that I invoke the miniscule probability of voter decisiveness. If I had a 5% chance of tipping an electoral outcome, I might hold my nose, scrupulously compare the leading candidates, and vote for the Lesser Evil. Indeed, if, like von Stauffenberg, I had a 50/50 shot of saving millions of innocent lives by putting my own in grave danger, I’d consider it. But I refuse to traumatize myself for a one-in-a-million chance of moderately improving the quality of American governance. And one-in-a-million is grossly optimistic.

Caplan links to a portion of his lecture notes for a course in the logic of collective action. The notes include this mathematical argument:

III. Calculating the Probability of Decisiveness, I: Mathematics

A. When does a vote matter? At least in most systems, it only matters if it “flips” the outcome of the election.

B. This can only happen if the winner wins by a single vote. In that case, each voter is “decisive”; if one person decided differently, the outcome would change.

C. In all other cases, the voter is not decisive; the outcome would not change if one person decided differently.

D. It is obvious that the probability of casting the decisive vote in a large electorate is extremely small….

H. Now suppose that everyone but yourself votes “for” with probability p – and “against” with probability (1-p).

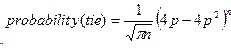

I. Then from probability theory:

J. From this formula, we can see that the probability of a tie falls when the number of voters goes up….

K. Intuitively, the more people there are, the less likely one person makes a difference….

IV. Calculating the Probability of Decisiveness, II: Examples

A. What is neat about the above formula is that it allows us to say not just how the probability of decisiveness changes, but how much….

I. Upshot: For virtually any real-world election, the probability of casting the decisive vote is not just small; it is normally infinitesimal. The extreme observation that “You will not affect the outcome of an election by voting” is true for all practical purposes.

J. Even if you were to play around with the formula to increase your estimate a thousand-fold, your estimated answer would remain vanishingly small.

What Caplan and other economists who write in the same vein ignore is the influence of their point of view. It’s self-defeating because it appeals to extremely rationalistic people like Caplan. One aspect of their rationalism is a cold-eyed view of government, namely, that it almost always does more harm than good. That’s a position with which I agree, but it’s a reason to vote rather than abstain. If rationalists like Caplan abstain from voting in large numbers, their abstention may well cause some elections to be won by candidates who favor more government rather than less.

Moreover, Caplan’s argument against voting is really a way of rationalizing his disdain for voting. This is from “Why I Don’t Vote: The Honest Truth”:

My honest answer begins with extreme disgust. When I look at voters, I see human beings at their hysterical, innumerate worst. When I look at politicians, I see mendacious, callous bullies. Yes, some hysterical, innumerate people are more hysterical and innumerate than others. Yes, some mendacious, callous bullies are more mendacious, callous, and bully-like than others. But even a bare hint of any of these traits appalls me. When someone gloats, “Politifact says Trump is pants-on-fire lying 18% of the time, versus just 2% for Hillary,” I don’t want to cheer Hillary. I want to retreat into my Bubble, where people dutifully speak the truth or stay silent.

Thus demonstrating the confirmation bias in Caplan’s mathematical “proof” of the futility of voting.

Nor is his “proof” really probabilistic. A single event — be it an election, a lottery drawing, of the toss of a fair coin — doesn’t have a probability. What does it mean to say, for example, that there’s a probability of 0.5 (50 percent) that a tossed coin will come up heads (H), and a probability of 0.5 that it will come up tails (T)? Does such a statement have any bearing on the outcome of a single toss of a coin? No, it doesn’t. The statement is only a shorthand way of saying that in a sufficiently large number of tosses, approximately half will come up H and half will come up T. The result of each toss, however, is a random event — it has no probability. You may have an opinion (or a hunch or a guess) about the outcome of a single coin toss, but it’s only your opinion (hunch, guess). In the end, you have to bet on a discrete outcome.

An election that hasn’t taken place can’t have a probability. There will be opinion polls — a lot of them in the case of a presidential election — but choosing to vote (or not) because of opinion polls can be self-defeating. Take the recent presidential election. Almost all of the polls, including those that forecast the electoral vote as well as the popular vote, had Mrs. Clinton winning over Mr. Trump.

But despite the high “probability” of a victory by Mrs. Clinton, she lost. Why? Because the “ignorant” voters in several swing States turned out in large numbers, while too many pro-Clinton voters evidently didn’t bother to vote. It’s possible that she lost some crucial States because of the abstention of voters who believed the high “probability” that she would win.

The election of 2016 — like every other election — isn’t even close to being something as simple as the toss of a fair coin. And, despite its mathematical precision, a statement about the probability of the next toss of a fair coin is meaningless. It will come up H or it will come up T, but it will not come up 0.5 H or T.

REDUCTIONISM

This subject is more important than probability, so I will say far less about it.

Reductionism is the adoption of a theory or method which holds that a complex idea or system can be completely understood in terms of its simpler components. Most reductionists will defend their theory or method by agreeing that it is simple, if not simplistic. But they will nevertheless adhere to that theory or method because it’s “the best we have.” That claim should remind you of the hoary joke about the drunk who searched for his keys under a street light because he could see the ground there, even though he had dropped the keys half a block away.

Caplan’s adherence to the simplistic, mathematical analysis of voting is a good example of reductionism. Why? Because it omits the crucial influence of group behavior. It also omits other reasons for voting (or not). It certainly omits Caplan’s real reason, which is his “extreme disgust” for voters and the candidates from whom they must choose. Finally, it omits the psychic value of voting — its “feel good” effect.

Economists also are guilty of reductionism when they suggest that persons act rationally only when they pursue the maximization of income or wealth. I’ll say more about that when I get to paternalism.

NIRVANA FALLACY

The nirvana fallacy is the logical error of comparing actual things with unrealistic, idealized alternatives. The actual things usually are the “somethings” about which government is supposed to “do something.” The unrealistic, idealized alternatives are the outcomes sought by the proponents of a particular course of government action.

There is also a pervasive nirvana fallacy about government itself. Government — which is a mere collection of fallible, squabbling, power-lusting humans — is too often thought and spoken of as if it were a kind of omniscient, single-minded, benevolent being that can overcome the forces of nature and human nature which give rise, in the first place, to the “something” about which “something must be done.”

Specific examples of the nirvana fallacy will arise in later chapters of this book.

SOCIAL WELFARE

Wouldn’t you like to arrange the world so that everyone is better off? If you would — and I suspect that most people would — you’d have to define “better off.” Happier, healthier, and wealthier make a good starting point. Of course, you’d have to arrange it so that everyone would be happier and healthier and wealthier in the future as well as in the present. That is, for example, you couldn’t arrange greater happiness at the cost of greater wealth, or at the cost of the greater happiness or wealth of those living today or their descendants.

It’s a tall order isn’t it? In fact, it’s an impossibility. (You might even call it a state of nirvana.) In the real world of limited resources, the best that can happen is that a change of some kind (e.g., the invention of an anti-polio vaccine, hybridization to produce healthier and more abundant crops) makes it possible for many people to be better off — but at a price. There is no free lunch. Someone must bear the costs of devising and implementing beneficial changes. In market economies, those costs are borne by the people who reap the benefits because they (the beneficiaries) voluntarily pay for whatever it is that makes their lives better.

Enter government, whose agents decide such things what lines of medical research to fund, and how much to spend on each line of research. A breakthrough in a line of research might be a boon to millions of Americans. But other millions of Americans — many more millions, in fact — won’t benefit from the breakthrough, though a large fraction of them will have funded the underlying research through taxes extracted from them by force. I say by force because tax collections would decline sharply if it weren’t for the credible threat of heavy fines and imprisonment tax collections.

A voluntary exchange results when each of the parties to the exchange believes that he will be better off as a result of the exchange. An honest voluntary exchange — one in which there is no deception or material lack of information — therefore improves the well-being (welfare) of all parties. An involuntary exchange, as in the case of tax-funded medical research, cannot result make all parties better off. No government agent — or economist, pundit, or politician — can look into the minds of millions of people and say that each of them would willingly donate a certain amount of money to fund this or that government program. And yet, that is the presumption which lies behind government spending.

That presumption is the fallacious foundation of cost-benefit analysis undertaken to evaluate government programs. If the “social benefit” of a program is said to equal or exceed its cost, the program is presumably justified because the undertaking of it would cause “social welfare” to increase. But a “social benefit” — like a breakthrough in medical research — is a always a benefit to some persons, while the taxes paid to elicit the benefit are nothing but a burden to other persons, who have their own problems and priorities.

Why doesn’t the good outweigh the bad? Think of it this way: If a bully punches you in the nose, thus deriving much pleasure at your expense, who is to say that the bully’s pleasure outweighs your pain? Do you believe that there’s a third party who is entitled to say that the result of your transaction with the bully is a heightened state of social welfare? Evidently, there are a lot of voters, economists, pundits, and politician who act as if they believe it.

ROMANTICIZING THE STATE

This section is a corollary to the preceding one.

It is a logical and factual error to apply the collective “we” to Americans, except when referring generally to the citizens of the United States. Other instances of “we” (e.g., “we” won World War II, “we” elected Barack Obama) are fatuous and presumptuous. In the first instance, only a small fraction of Americans still living had a hand in the winning of World War II. In the second instance, Barack Obama was elected by amassing the votes of fewer than 25 percent of the number of Americans living in 2008 and 2012. “We the People” — that stirring phrase from the Constitution’s preamble — was never more hollow than it is today.

Further, the logical and factual error supports the unwarranted view that the growth of government somehow reflects a “national will” or consensus of Americans. Thus, appearances to the contrary (e.g., the adoption and expansion of national “social insurance” schemes, the proliferation of cabinet departments, the growth of the administrative state) a sizable fraction of Americans (perhaps a majority) did not want government to grow to its present size and degree of intrusiveness. And a sizable fraction (perhaps a majority) would still prefer that it shrink in both dimensions. In fact, The growth of government is an artifact of formal and informal arrangements that, in effect, flout the wishes of many (most?) Americans. The growth of government was not and is not the will of “we Americans,” “Americans on the whole,” “Americans in the aggregate,” or any other mythical consensus.

PATERNALISM

Paternalism arises from the same source as “social welfare”; that is, it reflects a presumption that there are some persons who are competent to decide what’s best for other persons. That may be true of parents, but it is most assuredly not true of so-called libertarian paternalists.

Consider an example that’s used to explain libertarian paternalism. Some workers choose “irrationally” — according to libertarian paternalists — when they decline to sign up for an employer’s 401(k) plan. The paternalists characterize the “do not join” option as the default option. In my experience, there is no default option: An employee must make a deliberate choice between joining a 401(k) or not joining it. And if the employee chooses not to join it, he or she must sign a form certifying that choice. That’s not a default, it’s a clear-cut and deliberate choice which reflects the employee’s best judgment, at that time, as to the best way to allocate his or her income. Nor is it an irrevocable choice; it can be revisited annually (or more often under certain circumstances).

But to help employees make the “right” choice, libertarian paternalists would find a way to herd employees into 401(k) plans (perhaps by law). In one variant of this bit of paternalism, an employee is automatically enrolled in a 401(k) and isn’t allowed to opt out for some months, by which time he or she has become used to the idea of being enrolled and declines to opt out.

The underlying notion is that people don’t always choose what’s “best” for themselves. Best according to whom? According to libertarian paternalists, of course, who tend to equate “best” with wealth maximization. They simply disregard or dismiss the truly rational preferences of those who must live with the consequences of their decisions.

Libertarian paternalism incorporates two fallacies. One is what I call the rationality fallacy (a kind of reductionism), the other is the fallacy of central planning.

As for the rationality fallacy, there is simply a lot more to maximizing satisfaction than maximizing wealth. That’s why some couples choose to have a lot of children, when doing so obviously reduces the amount of wealth that they can accumulate. That’s why some persons choose to retire early rather than stay in stressful jobs. Rationality and wealth maximization are two very different things, but a lot of laypersons and too many economists are guilty of equating them.

Nevertheless, many economists do equate rationality and wealth maximization, which leads them to propose schemes for forcing us to act more “rationally.” Such schemes, of course, are nothing more than central planning, dreamt up by self-anointed wise men who seek to impose their preferences on the rest of us. They are, in other words, schemes to maximize that which can’t be maximized: social welfare.

JUDGING MOTIVES INSTEAD OF RESULTS

If a person commits what seems to be an altruistic act, that person may seem to sacrifice something (e.g., a life, a fortune) but the “sacrifice” was that person’s choice. An altruistic act serves an end: the satisfaction of one’s personal values — nothing more, nothing less. There is nothing inherent in a supposedly altruistic act that makes it morally superior to profit-seeking, which is usually thought of as the opposite of altruism.

To illustrate my point I resort to the following bits of caricature:

1. Suppose Mother Teresa’s acts of “sacrifice” were born of rebellion against parents who wanted her to take over their business empire. That is, suppose Mother Teresa derived great satisfaction in defying her parents, and it is that which drove her to impoverish herself and suffer many hardships. The more she “suffered” the more her parents suffered and the happier she became.

2. Suppose Bill Gates really wanted to become a male version of Mother Teresa but his grandmother, on her deathbed, said “Billy, I want you to make the world safe from the Apple computer.” So, Billy went out and did that, for his grandmother’s sake, even though he really wanted to be the male Mother Teresa. Then he wound up being immensely wealthy, much to his regret. But Billy obviously put his affection for or fear of his grandmother above his desire to become a male version of Mother Teresa. He satisfied his personal values. And in doing so, he make life better for millions of people, many millions more than were served by Mother Teresa’s efforts. It’s just that Billy’s efforts weren’t heart-rending, and were seemingly motivated by profit-seeking.

Now, tell me, who is the altruist, my fictional Mother Teresa or my fictional Bill Gates? You might now say Bill Gates. I would say neither; each acted in accordance with her and his personal values. One might call the real Mother Teresa altruistic because her actions seem altruistic, in the common meaning of the word. But one can’t say (for sure) why she took those actions. Suppose that the real Mother Teresa acted as she did not only because she wanted to help the poor but also because she sought spiritual satisfaction or salvation. Would that negate her acts? No, her acts would still be her acts, regardless of their motivation. The same goes for the real Bill Gates.

Results matter more than motivations. (“The road to hell,” and all that.) It is arguable that profit-seekers like the real Bill Gates — and the real John D. Rockefeller, Andrew Carnegie, Henry Ford, and their ilk — brought more happiness to humankind than did Mother Teresa and others of her ilk.

That insight is at least 240 years old. Adam Smith put it this way in The Wealth of Nations (1776):

By pursuing his own interest [a person] frequently promotes that of the society more effectually than when he really intends to promote it. I have never known much good done by those who affected to trade for the public good.

A person who makes a profit makes it by doing something of value for others.