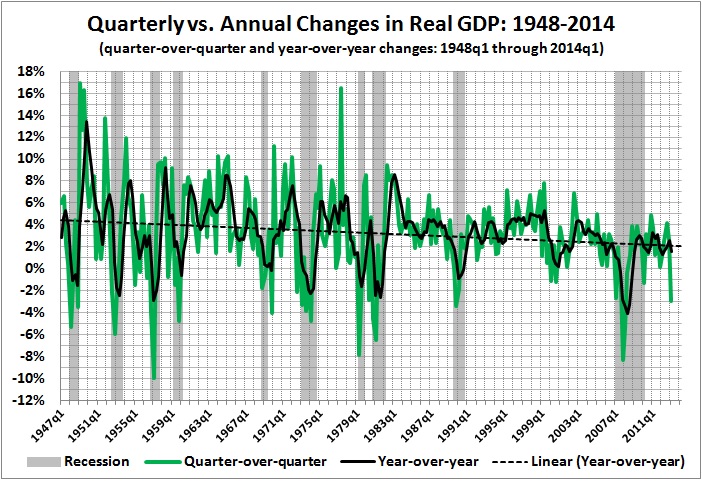

Today’s big economic news is the decline in real GDP reported by the Department of Commerce’s Bureau of Economic Analysis (BEA): an annualized rate of minus 2.9 percent from the fourth quarter of 2013 to the first quarter of 2014. Except for times when the economy was in or near recession, that’s the largest decline recorded since the advent of quarterly GDP estimates:

Derived from the “Current dollar and real GDP series” issued by BEA. See this post for my definition of a recession.

What’s the silver lining? Quarter-to-quarter changes in real GDP are more volatile than year-over-year and long-run changes. Some will take solace in the fact that real GDP rose by (a measly) 1.5 percent between the first quarter or 2013 and the first quarter of 2014. (Though they will conveniently ignore the long-run trend, marked by the dashed line in the graph.)

What’s the cloud? Well, as I pointed out above, the quarter-to-quarter decline in the first quarter of 2014 is unprecedented in the post-World War II era. Unless the sharp drop in the first quarter of 2014 is a one-off phenomenon (as suggested by some cheerleaders for Obamanomics), it points two possibilities:

- The economy is in recession, as will become evident when the BEA reports on GDP for the second quarter of 2014.

- The economy isn’t in recession — strictly speaking — but the dismal performance in the first quarter presages an acceleration of the downward trend marked by the dashed line in the graph. (For those of you who care about such things, the chance that the trend line reflects random “noise” in GDP statistics is less than 1 in 1 million.)

Even if there’s a rebound in the second quarter of 2014, the big picture is clear: The economy is in long-term decline, for reasons that I’ve discussed in the following posts:

The Laffer Curve, “Fiscal Responsibility,” and Economic Growth

The Causes of Economic Growth

In the Long Run We Are All Poorer

A Short Course in Economics

Addendum to a Short Course in Economics

The Price of Government

The Price of Government Redux

The Mega-Depression

As Goes Greece

Ricardian Equivalence Reconsidered

The Real Burden of Government

The Illusion of Prosperity and Stability

Taxing the Rich

More about Taxing the Rich

A Keynesian Fantasy Land

The Keynesian Fallacy and Regime Uncertainty

Why the “Stimulus” Failed to Stimulate

The “Jobs Speech” That Obama Should Have Given

Say’s Law, Government, and Unemployment

Unemployment and Economic Growth

Regime Uncertainty and the Great Recession

Regulation as Wishful Thinking

The Real Multiplier

The Commandeered Economy

We Owe It to Ourselves

In Defense of the 1%

Lay My (Regulatory) Burden Down

The Burden of Government

Economic Growth Since World War II

The Economy Slogs Along

Government in Macroeconomic Perspective

Keynesianism: Upside-Down Economics in the Collectivist Cause

The Price of Government, Once More

Economic Horror Stories: The Great “Demancipation” and Economic Stagnation

Economics: A Survey (also here)

Why Are Interest Rates So Low?

Vulgar Keynesianism and Capitalism

Estimating the Rahn Curve: Or, How Government Spending Inhibits Economic Growth

America’s Financial Crisis Is Now

The Keynesian Multiplier: Phony Math

The True Multiplier

The Obama Effect: Disguised Unemployment

Obamanomics: A Report Card

See especially “Regime Uncertainty and the Great Recession,” “Estimating the Rahn Curve: Or, How Government Spending Inhibits Economic Growth,” and “The True Multiplier.”