UPDATED 01/07/15

The left loves Thomas Piketty‘s Capital in the Twenty-First Century because it lends pseudo-scientific backing to some of the left’s favorite economic postulates; to wit:

- Income inequality is bad, even if real incomes are rising across the board. Why is it bad? It just is, if you’re an envious Marxist. But also…

- Income inequality is bad because wealth usually derives from income. The rich get richer, as the old song goes. And the rich — the super-rich, in today’s parlance — acquire inordinate political power because of their great wealth. (Leftists conveniently overlook the fact that the penchant for statist schemes — redistributionism among them — is positively correlated with income. This is a morally confused stance, based on guilt-feelings and indoctrination at the hands of leftist “educators,” “journalists,” and “entertainers.”)

- Further, inequality yields slower economic growth because persons with high incomes consume a smaller fraction of their incomes than do persons with low incomes. The result, according to the Keynesian consumption-based model, is a reduction in GDP, other things being the same. And other things being the same, slower growth means that it is harder for low-income persons to rise from poverty or near-poverty. (This is a logically and empirically backward view of reality, which is that economic growth requires more investment and less consumption. And investment spending is stifled when redistribution takes money from high earners and gives it to low earners, that is, persons with a high propensity to consume. Investment is also stifled by progressive taxation, which penalizes success, and burdensome regulation, which deters entrepreneurship and job creation.)

Deirdre McCloskey‘s forthcoming review of Piketty’s book praises it and damns it. First the praise:

Piketty gives a fine example of how to do it [economic history]. He does not get entangled as so many economists do in the sole empirical tool they are taught, namely, regression analysis on someone else’s “data”…. Therefore he does not commit one of the two sins of modern economics, the use of meaningless “tests” of statistical significance…. Piketty constructs or uses statistics of aggregate capital and of inequality and then plots them out for inspection, which is what physicists, for example, also do in dealing with their experiments and observations. Nor does he commit the other sin, which is to waste scientific time on existence theorems. Physicists, again, don’t. If we economists are going to persist in physics envy let’s at least learn what physicists actually do. Piketty stays close to the facts, and does not, say, wander into the pointless worlds of non-cooperative game theory, long demolished by experimental economics. He also does not have recourse to non-computable general equilibrium, which never was of use for quantitative economic science, being a branch of philosophy, and a futile one at that. On both points, bravissimo.

His book furthermore is clearly and unpretentiously, if dourly, written….

That comes early in McCloskey’s long review (50 double-spaced pages in the .pdf version). But she ends with blistering damnation:

On the next to last page of his book Piketty writes, “It is possible, and even indispensable, to have an approach that is at once economic and political, social and cultural, and concerned with wages and wealth.” One can only agree. But he has not achieved it. His gestures to cultural matters consist chiefly of a few naively used references to novels he has read superficially—for which on the left he has been embarrassingly praised. His social theme is a narrow ethic of envy. His politics assumes that governments can do anything they propose to do. And his economics is flawed from start to finish.

It is a brave book. But it is mistaken.

There is much in between to justify McCloskey’s conclusion. Here she puts Piketty’s work in context:

[T]he left in its worrying routinely forgets this most important secular event since the invention of agriculture—the Great Enrichment of the last two centuries—and goes on worrying and worrying, like the little dog worrying about his bone in the Traveler’s insurance company advertisement on TV, in a new version every half generation or so.

Here is a partial list of the worrying pessimisms, which each has had its day of fashion since the time, as the historian of economic thought Anthony Waterman put it, “Malthus’ first [1798] Essay made land scarcity central. And so began a century-long mutation of ‘political economy,’ the optimistic science of wealth, to ‘economics,’ the pessimistic science of scarcity.” Malthus worried that workers would proliferate and Ricardo worried that the owners of land would engorge the national product. Marx worried, or celebrated, depending on how one views historical materialism, that owners of capital would at least make a brave attempt to engorge it…. Mill worried, or celebrated, depending on how one views the sick hurry of modern life, that the stationary state was around the corner. Then the economists, many on the left but some on the right, in quick succession 1880 to the present—at the same time that trade-tested betterment was driving real wages up and up and up—commenced worrying about, to name a few of the grounds for pessimisms they discerned concerning ”capitalism”: greed, alienation, racial impurity, workers’ lack of bargaining strength, women working, workers’ bad taste in consumption, immigration of lesser breeds, monopoly, unemployment, business cycles, increasing returns, externalities, under-consumption, monopolistic competition, separation of ownership from control, lack of planning, post-War stagnation, investment spillovers, unbalanced growth, dual labor markets, capital insufficiency … , peasant irrationality, capital-market imperfections, public choice, missing markets, informational asymmetry, third-world exploitation, advertising, regulatory capture, free riding, low-level traps, middle-level traps, path dependency, lack of competitiveness, consumerism, consumption externalities, irrationality, hyperbolic discounting, too big to fail, environmental degradation, underpaying of care, overpayment of CEOs, slower growth, and more.

One can line up the later items in the list, and some of the earlier ones revived à la Piketty or Krugman…. I will not name here the men … , but can reveal their formula: first, discover or rediscover a necessary condition for perfect competition or a perfect world (in Piketty’s case, for example, a more perfect equality of income). Then assert without evidence (here Piketty does a great deal better than the usual practice) but with suitable mathematical ornamentation (thus Jean Tirole, Nobel 2014) that the condition might be imperfectly realized or the world might not develop in a perfect way. Then conclude with a flourish (here however Piketty falls in with the usual low scientific standard) that “capitalism” is doomed unless experts intervene with a sweet use of the monopoly of violence in government to implement anti-trust against malefactors of great wealth or subsidies to diminishing-returns industries or foreign aid to perfectly honest governments or money for obviously infant industries or the nudging of sadly childlike consumers or, Piketty says, a tax on inequality-causing capital worldwide. A feature of this odd history of fault-finding and the proposed statist corrections, is that seldom does the economic thinker feel it necessary to offer evidence that his … proposed state intervention will work as it is supposed to, and almost never does he feel it necessary to offer evidence that the imperfectly attained necessary condition for perfection before intervention is large enough to have reduced much the performance of the economy in aggregate.

I heartily agree with McCloskey’s diagnosis of the causes of leftist worrying:

One begins to suspect that the typical leftist … starts with a root conviction that capitalism is seriously defective. The conviction is acquired at age 16 years when the proto-leftist discovers poverty but has no intellectual tools to understand its source. I followed this pattern, and therefore became for a time a Joan-Baez socialist. Then the lifelong “good social democrat,” as he describes himself (and as I for a while described myself), when he has become a professional economist, in order to support the now deep-rooted conviction, looks around for any qualitative indication that in some imagined world the conviction would be true, without bothering to ascertain numbers drawn from our own world…. It is the utopianism of good-hearted leftward folk who say, “Surely this wretched society, in which some people are richer and more powerful than others, can be greatly improved. We can do much, much better!”

Piketty’s typically leftist blend of pessimism and utopianism is hitched to bad economic reasoning, ignorance of economic history, and a misreading of his own statistics:

Piketty’s (and Aristotle’s) theory is that the yield on capital usually exceeds the growth rate of the economy, and so the share of capital’s returns in national income will steadily increase, simply because interest income—what the presumably rich capitalists get and supposedly manage to cling to and supposedly reinvest—is growing faster than the income the whole society is getting.

Aristotle and his followers, such as Aquinas and Marx and Piketty, were much concerned with such “unlimited” gain. The argument is, you see, very old, and very simple. Piketty ornaments it a bit with some portentous accounting about capital-output ratios and the like, producing his central inequality about inequality: so long as r > g, where r is the return on capital and g is the growth rate of the economy, we are doomed to ever increasing rewards to rich capitalists while the rest of us poor suckers fall relatively behind. The merely verbal argument I just gave, however, is conclusive, so long as its factual assumptions are true: namely, only rich people have capital; human capital doesn’t exist; the rich reinvest their return; they never lose it to sloth or someone else’s creative destruction; inheritance is the main mechanism, not a creativity that raises g for the rest of us just when it results in an r shared by us all; and we care ethically only about the Gini coefficient, not the condition of the working class. Notice one aspect of that last: in Piketty’s tale the rest of us fall only relatively behind the ravenous capitalists. The focus on relative wealth or income or consumption is one serious problem in the book. Piketty’s vision of a “Ricardian Apocalypse,” as he calls it, leaves room for the rest of us to do very well indeed, most non-apocalyptically, as in fact since 1800 we have. What is worrying Piketty is that the rich might possibly get richer, even though the poor get richer, too. His worry, in other words, is purely about difference, about the Gini coefficient, about a vague feeling of envy raised to a theoretical and ethical proposition.

Another serious problem is that r will almost always exceed g, as anyone can tell you who knows about the rough level of interest rates on invested capital and about the rate at which most economies have grown (excepting only China recently, where contrary to Piketty’s prediction, inequality has increased). If his simple logic is true, then the Ricardian Apocalypse looms, always. Let us therefore bring in the sweet and blameless and omni-competent government—or, even less plausibly, a world government, or the Gallactic Empire—to implement “a progressive global tax on capital” (p. 27) to tax the rich. It is our only hope…. In other words, Piketty’s fears were not confirmed anywhere 1910 to 1980, nor anywhere in the long run at any time before 1800, nor anywhere in Continental Europe and Japan since World War II, and only recently, a little, in the United States, the United Kingdom, and Canada (Canada, by the way, is never brought into his tests).

That is a very great puzzle if money tends to reproduce itself, always, evermore, as a general law governed by the Ricardo-plus-Marx inequality at the rates of r and g actually observed in world history. Yet inequality in fact goes up and down in great waves, for which we have evidence from many centuries ago down to the present, which also doesn’t figure in such a tale (Piketty barely mentions the work of the economic historians Peter Lindert and Jeffrey Williamson documenting the inconvenient fact). According to his logic, once a Pikettywave starts—as it would at any time you care to mention if an economy satisfied the almostalways-satisfied condition of the interest rate exceeding the growth rate of income—it would never stop. Such an inexorable logic means we should have been overwhelmed by an inequality-tsunami in 1800 CE or in 1000 CE or for that matter in 2000 BCE. At one point Piketty says just that: “r > g will again become the norm in the twenty-first century, as it had been throughout history until the eve of World War I (… one wonders what he does with historically low interest rates right now, or the negative real interest rates in the inflation of the 1970s and 1980s). Why then did the share of the rich not rise anciently to 100 percent?

McCloskey gets it right:

With a bigger pie, someone has to get more. In the event what rose were wages on raw labor and especially a great accumulation of human capital, but capital owned by the laborers, not by the truly rich. The return to physical capital was higher than a riskless return on British or American government bonds, in order to compensate for the risk in holding capital (such as being made obsolete by betterment—think of your computer, obsolete in four years). But the return on physical capital, and on human capital, was anyway held down to its level of very roughly 5 to 10 percent by competition among the proliferating capitalists. Imagine our immiserization if the income of workers, because they did not accumulate human capital, and their societies had not adopted the accumulation of ingenuities since 1800, had experienced the history of stagnation since 1800 that the per-unit return to capital has. It is not hard to imagine, because such miserable income of workers exists even now in places like Somalia and North Korea. Instead, since 1800 in the average rich country the income of the workers per person increased by a factor of about 30 (2,900 percent, if you please) and in even in the world as a whole, including the still poor countries, by a factor of 10 (900 percent), while the rate of return to physical capital stagnated.

Piketty does not acknowledge that each wave of inventors, of entrepreneurs, and even of routine capitalists find their rewards taken from them by entry, which is an economic concept he does not appear to grasp. Look at the history of fortunes in department stores. The income from department stores in the late nineteenth century, in Le Bon Marché, Marshall Fields, and Selfridge’s, was entrepreneurial. The model was then copied all over the rich world, and was the basis for little fortunes in Cedar Rapids, Iowa and Benton Harbor, Michigan. Then in the late twentieth century the model was challenged by a wave of discounters, and they then in turn by the internet. The original accumulation slowly or quickly dissipates. In other words, the profit going to the profiteers is more or less quickly undermined by outward-shifting supply, if governmental monopolies and protectionisms of the sort Matt Ridley noted in recent British history do not intervene. The economist William Nordhaus has calculated that the inventors and entrepreneurs nowadays earn in profit only 2 percent of the social value of their inventions. If you are Sam Walton the 2 percent gives you personally a great deal of money from introducing bar codes into stocking of supermarket shelves. But 98 percent at the cost of 2 percent is nonetheless a pretty good deal for the rest of us. The gain from macadamized roads or vulcanized rubber, then modern universities, structural concrete, and the airplane, has enriched even the poorest among us.

But Piketty doesn’t see this because he’s a poor economist and a knee-jerk socialist:

Piketty, who does not believe in supply responses [as discussed below], focuses instead on the great evil of very rich people having seven Rolex watches by mere inheritance. Lillian Bettancourt, heiress to the L’Oréal fortune (p. 440), the third richest woman in the world, who “has never worked a day in her life, saw her fortune grow exactly as fast as that of [the admittedly bettering] Bill Gates.” Ugh, Piketty says, which is his ethical philosophy in full.

* * *

[T]he effect of inherited wealth on children is commonly to remove their ambition, as one can witness daily on Rodeo Drive. Laziness—or for that matter regression to the mean of ability—is a powerful equalizer. “There always comes a time,” Piketty writes against his own argument, “when a prodigal child squanders the family fortune” (p. 451), which was the point of the centuries-long struggle in English law for and against entailed estates.

* * *

Because Piketty is obsessed with inheritance, moreover, he wants to downplay entrepreneurial profit, the trade-tested betterment that has made the poor rich. It is again Aristotle’s claim that money is sterile and interest is therefore unnatural. Aristotle was on this matter mistaken. It is commonly the case, contrary to Piketty, and setting aside the cheapening of our goods produced by the investments of their wealth by the rich, that the people with more money got their more by being more ingeniously productive, for the benefit of us all—getting that Ph.D., for example, or being excellent makers of automobiles or excellent writers of horror novels or excellent throwers of touchdown passes or excellent providers of cell phones, such as Carlos Slim of Mexico, the richest man in the world (with a little boost, it may be, from corrupting the Mexican parliament). That Frank Sinatra became richer than most of his fans was not an ethical scandal. The “Wilt Chamberlain” example devised by the philosopher Robert Nozick (Piketty mentions John Rawls, but not Nozick, Rawls’ nemesis) says that if we pay voluntarily to get the benefit of clever CEOs or gifted athletes there is no further ethical issue. The unusually high rewards to the Frank Sinatras and Jamie Dimons and Wilt Chamberlains come from the much wider markets of the age of globalization and mechanical reproduction, not from theft. Wage inequality in the rich countries experiencing an enlarging gap of rich vs. poor, few though the countries are (Piketty’s finding, remember: Canada, U.S.A., U.K.)), is mainly, he reports, caused by “the emergence of extremely high remunerations at the summit of the wage hierarchy, particularly among top managers of large firms.” The emergence, note, has nothing to do with r > g.

How poor an economist? Consider:

Piketty’s definition of wealth does not include human capital, owned by the workers, which has grown in rich countries to be the main source of income, when it is combined with the immense accumulation since 1800 of capital in knowledge and social habits, owned by everyone with access to them. Therefore his laboriously assembled charts of the (merely physical and private) capital/output ratio are erroneous. They have excluded one of the main forms of capital in the modern world. More to the point, by insisting on defining capital as something owned nearly always by rich people, Piketty mistakes the source of income, which is chiefly embodied human ingenuity, not accumulated machines or appropriated land.

* * *

The fundamental technical problem in the book, however, is that Piketty the economist does not understand supply responses….

Startling evidence of Piketty’s miseducation occurs as early as page 6. He begins by seeming to concede to his neoclassical opponents…. “To be sure, there exists in principle a quite simple economic mechanism that should restore equilibrium to the process [in this case the process of rising prices of oil or urban land leading to a Ricardian Apocalypse]: the mechanism of supply and demand. If the supply of any good is insufficient, and its price is too high, then demand for that good should decrease, which would lead to a decline in its price.” [This] clearly mix[es] up movement along a demand curve with movement of the entire curve, a first-term error at university. The correct analysis (we tell our first-year, first-term students at about week four) is that if the price is “too high” it is not the whole demand curve that “restores equilibrium” … , but an eventually outward-moving supply curve. The supply curve moves out because entry is induced by the smell of super-normal profits, in the medium and long run (which is the Marshallian definition of the terms). New oil deposits are discovered, new refineries are built, new suburbs are settled, new high-rises saving urban land are constructed, as has in fact happened massively since, say, 1973, unless government has restricted oil exploitation (usually on environmental grounds) or the building of high-rises (usually on corrupt grounds). Piketty goes on—remember: it does not occur to him that high prices cause after a while the supply curve to move out; he thinks the high price will cause the demand curve to move in, leading to “a decline in price” (of the scarce item, oil’s or urban land)—“such adjustments might be unpleasant or complicated.” To show his contempt for the ordinary working of the price system he imagines comically that “people should . . . take to traveling about by bicycle.” The substitutions along a given demand curve, or one mysteriously moving in, without any supply response “might also take decades, during which landlords and oil well owners might well accumulate claims on the rest of the population” (now he has the demand curve moving out, for some reason faster than the supply curve moves out) “so extensive that they could they could easily [on grounds not argued] come to own everything that can be owned, including” in one more use of the comical alternative, “bicycles, once and for all.” Having butchered the elementary analysis of entry and of substitute supplies, which after all is the economic history of the world, he speaks of “the emir of Qatar” as a future owner of those bicycles, once and for all. The phrase must have been written before the recent and gigantic expansion of oil and gas exploitation in Canada and the United States….

Piketty, it would seem, has not read with understanding the theory of supply and demand that he disparages, such as Smith (one sneering remark on p. 9), Say (ditto, mentioned in a footnote with Smith as optimistic), Bastiat (no mention), Walras (no mention), Menger (no mention), Marshall (no mention), Mises (no mention), Hayek (one footnote citation on another matter), Friedman (pp. 548-549, but only on monetarism, not the price system). He is in short not qualified to sneer at self-regulated markets (for example on p. 572), because he has no idea how they work. It would be like someone attacking the theory of evolution (which is identical to the theory the economists use of entry and exit in self-regulating markets—the supply response, an early version of which inspired Darwin) without understanding natural selection or the the Galton-Watson process or modern genetics.

McCloskey continues:

Beyond technical matters in economics, the fundamental ethical problem in the book is that Piketty has not reflected on why inequality by itself would be bad…. The motive of the true Liberal … should not be equality but [says Joshua Monk, a character in Anthony Trollope’s novel, Phineas] “the wish of every honest [that is, honorable] man . . . to assist in lifting up those below him.” Such an ethical goal was to be achieved, says Monk the libertarian liberal (as Richard Cobden and John Bright and John Stuart Mill were, and Bastiat in France at the time, and in our times Hayek and Friedman, or for that matter M’Cluskie), not by direct programs of redistribution, nor by regulation, nor by trade unions, but by free trade and tax-supported compulsory education and property rights for women—and in the event by the Great Enrichment, which finally in the late nineteenth century started sending real wages sharply up, Europe-wide, and then world-wide.

The absolute condition of the poor has been raised overwhelmingly more by the Great Enrichment than by redistribution. The economic historians Ian Gazeley and Andrew Newell noted in 2010 “the reduction, almost to elimination, of absolute poverty among working households in Britain between 1904 and 1937.” “The elimination of grinding poverty among working families,” they show, “was almost complete by the late thirties, well before the Welfare State.” Their Chart 2 exhibits income distributions in 1886 prices at 1886, 1906, 1938, and 1960, showing the disappearance of the classic line of misery for British workers, “round about a pound a week.”

And it didn’t stop there:

In 2013 the economists Donald Boudreaux and Mark Perry noted that “according to the Bureau of Economic Analysis, spending by households on many of modern life’s ‘basics’—food at home, automobiles, clothing and footwear, household furnishings and equipment, and housing and utilities—fell from 53 percent of disposable income in 1950 to 44 percent in 1970 to 32 percent today.” It is a point which the economic historian Robert Fogel had made in 1999 for a longer span. The economist Steven Horwitz summarizes the facts on labor hours required to buy a color TV or an automobile, and notes that “these data do not capture . . . the change in quality . . . . The 1973 TV was at most 25 inches, with poor resolution, probably no remote control, weak sound, and generally nothing like its 2013 descendant. . . . Getting 100,000 miles out of a car in the 1970s was cause for celebration. Not getting 100,000 miles out of a car today is cause to think you bought a lemon.”

Nor in the United States are the poor getting poorer. Horwitz observes that “looking at various data on consumption, from Census Bureau surveys of what the poor have in their homes to the labor time required to purchase a variety of consumer goods, makes clear that poor Americans are living better now than ever before. In fact, poor Americans today live better, by these measures, than did their middle class counterparts in the 1970s.” In the summer of 1976 an associate professor of economics at the University of Chicago had no air conditioning in his apartment. Nowadays many quite poor Chicagoans have it. The terrible heat wave in Chicago of July 1995 killed over 700 people, mainly low-income. Yet earlier heat waves in 1936 and 1948, before air-conditioning was at all common, had probably killed many more.

There is one point at which McCloskey almost veers off course, but she recovers nicely:

To be sure, it’s irritating that a super rich woman buys a $40,000 watch. The purchase is ethically objectionable. She really should be ashamed. She should be giving her income in excess of an ample level of comfort—two cars, say, not twenty, two houses, not seven, one yacht, not five—to effective charities…. But that many rich people act in a disgraceful fashion does not automatically imply that the government should intervene to stop it. People act disgracefully in all sorts of ways. If our rulers were assigned the task in a fallen world of keeping us all wholly ethical, the government would bring all our lives under its fatherly tutelage, a nightmare achieved approximately before 1989 in East Germany and now in North Korea.

And that is the key point, to my mind. Perfection always eludes the human race, even where its members have managed to rise from the primordial scramble for sustenance and above Hobbes’s “warre, as is of every man, against every man.” Economic progress without economic inequality is impossible, and efforts to reduce inequality by punishing economic success must inevitably hinder progress, which is built on the striving of entrepreneurs. Further, the methods used to punish economic success are anti-libertarian — whether they are the police-state methods of the Soviet Union or the “soft despotism” of the American regulatory-welfare state.

So what if an entrepreneur — an Edison, Rockefeller, Ford, Gates, or Jobs — produces something of great value to his fellow men, and thus becomes rich and adorns his spouse with a $40,000 watch, owns several homes, and so on? So what if that same entrepreneur is driven (in part, at least) by a desire to bestow great wealth upon his children? So what if that same entrepreneur chooses to live among and associate with other persons of great wealth? He has no obligation to “give back”; he has already given by providing his fellow men with something that they value enough to make him rich. (Similarly, the super-star athlete and actor.)

McCloskey gets the penultimate word:

Supposing our common purpose on the left and on the right, then, is to help the poor, … the advocacy by the learned cadres of the left for equalizing restrictions and redistributions and regulations can be viewed at best as thoughtless. Perhaps, considering what economic historians now know about the Great Enrichment, but which the left clerisy, and many of the right, stoutly refuse to learn, it can even be considered unethical. The left clerisy such as Tony Judt or Paul Krugman or Thomas Piketty, who are quite sure that they themselves are taking the ethical high road against the wicked selfishness of Tories or Republicans or La Union pour un Mouvement Populaire, might on such evidence be considered dubiously ethical. They are obsessed with first-[order] changes that cannot much help the poor, and often can be shown to damage them, and are obsessed with angry envy at the consumption of the uncharitable rich, of whom they personally are often examples (what will you do with your royalties, Professor Piketty?), and the ending of which would do very little to improve the position of the poor. They are very willing to stifle through taxing the rich the trade-tested betterments which in the long run have gigantically helped the poor, who were the ancestors of most of the rest of us.

I added the emphasis to underscore what seems to me to be the left’s greatest ethical offense in the matter of inequality, as it is in the matter of race relations: hypocrisy. Hypocritical leftists like Judt, Krugman, and Pikkety (to name only a few of their ilk) aren’t merely wrong in their views about how to help the (relatively) poor, they make money (and a lot of it) by espousing their erroneous views. They obviously see nothing wrong with making a lot of money. So why is it all right for them to make a lot of money — more than 99.9 percent of the world’s population, say — but not all right for other persons to make even more money? The dividing line between deservingness and greed seems always to lie somewhere above their munificent earnings.

UPDATE:

As John Cochrane notes,

Most Piketty commentary … focuses on the theory, r>g, and so on. After all, that’s easy and you don’t have to read hundreds of pages.

Cochrane then points to a paper by Philip W. Magness and Robert P. Murphy (listed below in “Related reading”) that focuses on the statistics that Piketty compiled and relied on to advance his case for global redistribution of income and wealth. Here is the abstract of the paper:

Thomas Piketty’s Capital in the 21st Century has been widely debated on theoretical grounds, yet continues to attract acclaim for its historically-infused data analysis. In this study we conduct a closer scrutiny of Piketty’s empirics than has appeared thus far, focusing upon his treatment of the United States. We find evidence of pervasive errors of historical fact, opaque methodological choices, and the cherry-picking of sources to construct favorable patterns from ambiguous data. Additional evidence suggests that Piketty used a highly distortive data assumption from the Soviet Union to accentuate one of his main historical claims about global “capitalism” in the 20th century. Taken together, these problems suggest that Piketty’s highly praised and historically-driven empirical work may actually be the book’s greatest weakness.

I’ve quickly read Magness and Murphy’s paper. It seems to live up to the abstract. Piketty (and friends) may challenge Magness and Murphy, but Piketty bears the burden of showing that he hasn’t stacked the empirical deck in favor of his redistributionist message. Not that the empirical flaws should matter, given the theoretical flaws exposed by McCloskey and others, but Piketty’s trove of spurious statistics should be discredited before it becomes a standard reference.

* * *

Related reading:

David R. Henderson, “An Unintended Case for More Capitalism,” Regulation, Fall 2014

John Cochrane, “Why and How We Care about Inequality,” The Grumpy Economist, September 29, 2014

John Cochrane, “Envy and Excess,” The Grump Economist, October 1, 2014

Mark J. Perry, “New CBO Study Shows That ‘The Rich’ Don’t Just Pay Their ‘Fair Share,’ They Pay Almost Everybody’s Share,” Carpe Diem, November 15, 2014

Mark J. Perry, “IRS Data Show That the Vast Majority of Taxpayers in the ‘Fortunate 400’ Are Only There for One Year,” Carpe Diem, November 25, 2014

Robert Higgs, “income Inequality Is a Statistical Artifact,” The Beacon (Independent Institute), December 1, 2014

John Cochrane, “McCloskey on Piketty and Friends,” The Grumpy Economist, December 2, 2014

James Pethokoukis, “IMF Study, ‘No Evidence ‘High-End’ Income Inequality Hurts Economic Growth,” AEI.org, December 9, 2014

Philip W. Magness and Robert P. Murphy, “Challenging the Empirical Contribution of Thomas Piketty’s Capital in the 21st Century,” Journal of Private Enterprise, forthcoming

Related posts:

Taxing the Rich

More about Taxing the Rich

The Keynesian Fallacy and Regime Uncertainty

Creative Destruction, Reification, and Social Welfare

Why the “Stimulus” Failed to Stimulate

Regime Uncertainty and the Great Recession

Regulation as Wishful Thinking

In Defense of the 1%

Lay My (Regulatory) Burden Down

Economic Growth Since World War II

Government in Macroeconomic Perspective

Keynesianism: Upside-Down Economics in the Collectivist Cause

How High Should Taxes Be?

The 80-20 Rule, Illustrated

Economics: A Survey

Estimating the Rahn Curve: Or, How Government Spending Inhibits Economic Growth

The Keynesian Multiplier: Phony Math

The True Multiplier

Some Inconvenient Facts about Income Inequality

Mass (Economic) Hysteria: Income Inequality and Related Themes

Social Accounting: A Tool of Social Engineering

Income Inequality and Inherited Wealth: So What?

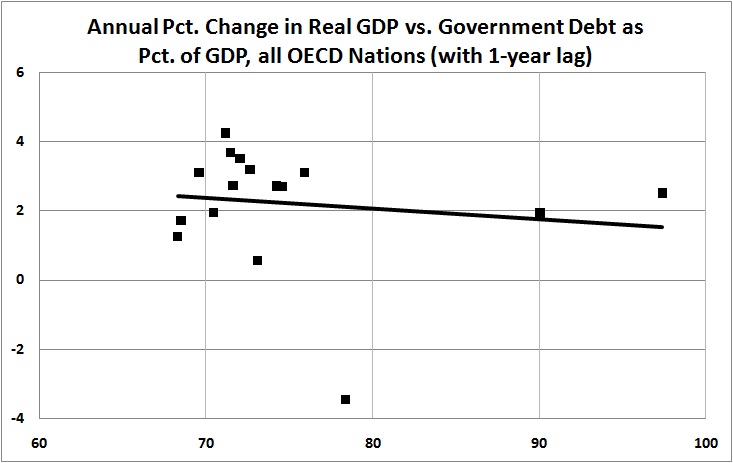

Income Inequality and Economic Growth

A Case for Redistribution, Not Made